Ethereum Price Prediction: Navigating Short-Term Volatility with Long-Term Bullish Fundamentals

#ETH

- Technical Positioning: ETH trades below key moving averages but shows bullish MACD divergence, suggesting potential reversal patterns

- Institutional Flow Dynamics: ETF outflows create short-term pressure while SWIFT's blockchain adoption provides long-term validation

- Ecosystem Development: Gas limit increases and network upgrades enhance Ethereum's scalability and utility foundation

ETH Price Prediction

ETH Technical Analysis: Bearish Signals Dominate Short-Term Outlook

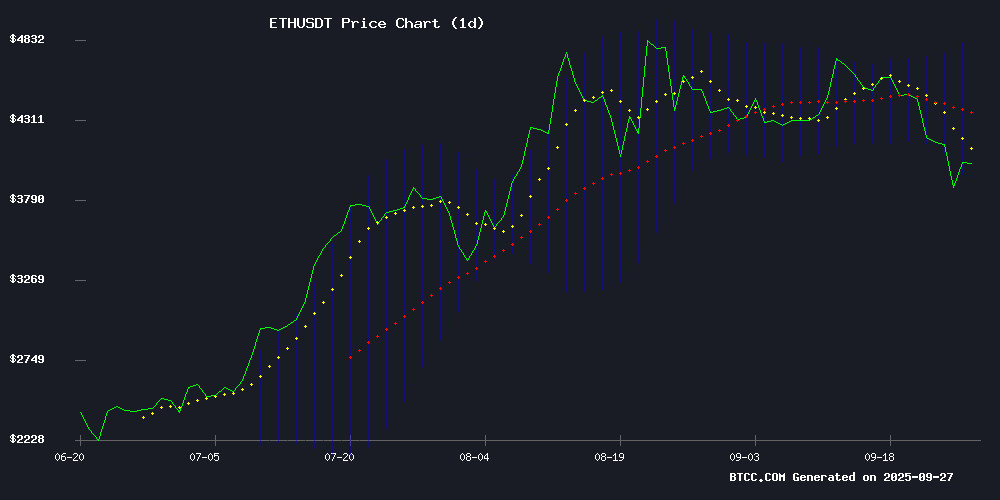

According to BTCC financial analyst Robert, Ethereum's current price of $4,026.09 sits significantly below its 20-day moving average of $4,372.69, indicating near-term bearish pressure. The MACD reading of 151.56 versus its signal line at 26.86 shows positive momentum, but the widening gap suggests potential volatility ahead. More concerning is ETH's position NEAR the lower Bollinger Band at $3,917.29, which often acts as a support level. If this level fails to hold, we could see further downside toward $3,800.

Robert notes that the current technical setup favors cautious optimism. 'While the MACD remains bullish, the price action relative to key moving averages and Bollinger Bands suggests we're in a corrective phase. Traders should watch the $3,900-$3,950 zone closely for potential buying opportunities,' he stated.

Market Sentiment Mixed Amid Institutional Outflows and Technical Developments

BTCC financial analyst Robert points to conflicting signals in Ethereum's fundamental landscape. 'The fourth consecutive day of ETF outflows combined with large whale movements creates near-term headwinds,' Robert observed. However, he highlights positive developments including the approved 60M gas limit in the Fusaka upgrade and SWIFT's blockchain integration progress as long-term bullish factors.

Robert suggests that while institutional outflows and whale activity indicate profit-taking, the underlying technology improvements through Ethereum's upgrades and mainstream adoption via SWIFT's pilot programs provide solid foundations for future growth. 'The market is digesting both positive and negative news, creating the current consolidation phase,' he added.

Factors Influencing ETH's Price

Ethereum Weekend Outlook: Recap and Forecast

Ethereum faces a critical juncture as it hovers near key support levels. The $3,900-$3,950 zone emerges as a battleground for bulls, with a decisive break above $4,020 potentially propelling ETH toward $4,200. Failure to hold support could trigger a swift decline to $3,700.

Market participants anticipate sideways consolidation in the $3,900-$4,020 range absent major catalysts. Macroeconomic developments and Fed rate expectations remain pivotal for sentiment. The crypto market still reels from this week's $1.8 billion liquidation event that erased Ethereum's brief rally above $4,300.

Developer activity maintains relevance with the Fusaka upgrade scheduled for December 2025. Weekend commentary or testnet progress could influence trader positioning. Ethereum's volatility underscores the asset's sensitivity to both technical factors and broader market currents.

Ethereum ETFs Face Fourth Day of Outflows as ETH Price Drops Below $3,900

Ethereum-focused exchange-traded funds recorded $251.20 million in net outflows on September 25, extending a four-day losing streak. Fidelity's FETH fund bore the brunt with $158 million withdrawn, while Grayscale's ETHE and Bitwise's ETHW saw $30 million and $27 million departures respectively. The bleeding pushed total weekly outflows past $547 million.

The exodus coincided with Ethereum's price sliding 2.3% to $3,939, now down 13% over seven trading sessions. Market technicians eye the $3,750-$3,800 range as critical support should the downtrend persist. Institutional appetite appears to be waning just as the asset tests psychological resistance at the $4,000 threshold.

Ethereum Co-Founder Moves $6M ETH to Kraken Amid Market Volatility

Jeffrey Wilcke, co-founder of Ethereum, transferred 1,500 ETH (approximately $6 million) to Kraken during a brief dip in Ethereum's price below $4,000. The move follows a pattern of significant deposits by Wilcke to the exchange, suggesting potential selling activity.

Despite the co-founder's transfer, large-scale Ethereum investors have been aggressively accumulating the asset, purchasing over $1.6 billion worth of ETH in just two days. This buying spree has seen whales acquiring ETH from major exchanges including Kraken, BitGo, and Galaxy Digital.

The market continues to see shifting strategies among major players, with one whale recently liquidating billions in Bitcoin to increase Ethereum exposure. Such moves highlight the dynamic nature of crypto asset allocation among institutional and whale investors.

Ethereum Developers Approve 60M Gas Limit in Upcoming Fusaka Upgrade

Ethereum developers have greenlit a pivotal upgrade, raising the network's gas limit to 60 million in the Fusaka hard fork. The move targets chronic congestion and soaring transaction fees, aiming to unlock higher throughput without sacrificing security.

Tim Beiko, an Ethereum Foundation contributor, confirmed the decision during the All Core Devs Execution call #221. Testnet deployments will commence in October, with mainnet activation expected shortly after—accelerating prior timelines that pointed to December.

The upgrade’s 60M gas limit marks a structural shift for Ethereum, enabling more transactions per block. It arrives as demand for block space intensifies amid growing institutional adoption and Layer-2 ecosystem expansion.

Governance updates accompany the technical overhaul: Proposals for the Glamsterdam upgrade face a October deadline, while a formal "EIP Champion" role will streamline protocol improvement processes. Developer Ad Dietrichs will chair ACDE meetings through year-end.

SWIFT Advances Blockchain Transition with Linea Pilot, Positioning Against Ripple

SWIFT, the global financial messaging network, has taken a decisive step toward modernizing interbank communications by launching a blockchain-based pilot program using Linea, an Ethereum Layer 2 platform. This initiative marks a strategic pivot for SWIFT as it tests onchain messaging and settlement systems, potentially redefining the efficiency and transparency of cross-border payments.

The pilot involves collaboration with major financial institutions, including BNP Paribas and BNY Mellon, leveraging Linea's zkEVM technology to enhance speed, reduce costs, and improve transaction tracking. SWIFT's move signals its intent to remain competitive in an industry increasingly shaped by blockchain innovation, directly challenging rivals like Ripple.

By integrating Ethereum-compatible solutions, SWIFT aims to address the limitations of its legacy infrastructure, which relies heavily on intermediaries. This transition underscores the growing institutional adoption of blockchain technology to streamline global financial operations.

SWIFT to Test On-Chain Messaging System on Consensys' Linea Blockchain

SWIFT, the global interbank messaging network, is advancing its blockchain integration by testing an on-chain system on Linea, a Layer 2 solution developed by Consensys. The trial involves major financial institutions such as BNP Paribas and BNY Mellon, aiming to assess blockchain's potential to streamline international payments. The multi-month experiment will explore programmable payment functionalities and the role of stablecoins in tokenized transactions.

The initiative reflects growing institutional interest in blockchain's capacity to reduce costs and enhance efficiency. By consolidating multiple transaction messages into single on-chain entries, SWIFT and participating banks anticipate smoother interoperability with tokenized assets like bonds and equities. This marks a pivotal step in modernizing legacy financial infrastructure.

Dormant Ethereum Whale Moves $800M in ETH After 8-Year Inactivity

A previously inactive Ethereum wallet holding 200,000 ETH (worth approximately $800 million) has resurfaced after eight years of dormancy. Blockchain analysts confirmed the movement from legacy addresses dating back to Ethereum's genesis period.

The transaction represents one of the largest dormant holdings activated this year, sparking speculation about the whale's intentions. Such movements often precede major market shifts, though the destination of funds remains undisclosed.

Dormant Ethereum Whales Move $785M in ETH After 8 Years, Sparking Market Speculation

Two Ethereum wallets inactive since 2017 suddenly transferred 200,000 ETH ($785 million) to new addresses, according to blockchain analytics firm Lookonchain. The funds originated from Bitfinex during Ethereum's early days, suggesting involvement from foundational network participants.

The entity behind these movements now controls 736,316 ETH ($2.89 billion) across eight wallets. While the purpose remains unclear, such large-scale transfers from dormant addresses often precede institutional custody arrangements or security upgrades. Ethereum currently trades at $3,942, leaving markets sensitive to potential sell pressure from early holders.

Hypervault Vanishes: $3.6M Drained in Suspected Rug Pull

Hypervault, a decentralized finance platform, has abruptly disappeared after approximately $3.6 million in user assets were siphoned off and laundered through Tornado Cash. The funds were initially bridged from Hyperliquid to Ethereum, converted into Ether, and nearly 752 ETH was funneled into the privacy-focused mixer. The platform's digital footprint—its website, X account, and Discord channel—has been erased, fueling suspicions of a premeditated exit scam.

Blockchain security firm PeckShield flagged the unauthorized transactions, which involved bridging assets to Ethereum and swapping them for ETH before obscuring the trail via Tornado Cash. The sudden deletion of Hypervault's online presence amplified concerns among analysts and users alike. Community members, including the pseudonymous "HypingBull," had previously raised alarms about discrepancies in the team's audit claims, but warnings went unheeded.

Crypto Founder Loses $1M in Phishing Attack as Investors Shift Focus to Secure Alternatives

A $1 million phishing attack targeting Alex Choi, founder of Fortune Collective, has exposed vulnerabilities in Ethereum's new EIP-7702 transaction feature. Security firm SlowMist reveals the exploit involved a malicious contract disguised as a Uniswap swap, granting unauthorized access to funds.

The incident has intensified scrutiny of EIP-7702 implementations, with Wintermute reporting over 90% of delegations link to malicious contracts. This security breach coincides with growing investor interest in projects like Digitap ($TAP), which emphasizes built-in security and offers practical financial tools including a multi-currency app and Visa integration.

Market participants are increasingly prioritizing altcoins that address DeFi complexity and security concerns. The episode underscores the persistent tension between blockchain innovation and user protection in cryptocurrency ecosystems.

DeFi Platform Hypervault Goes Offline Following $3.6M Rugpull

Hypervault, a decentralized finance platform, has abruptly gone offline after $3.6 million in suspicious withdrawals. Analysts report the funds were moved from Hypervault’s Hyperliquid platform to Ethereum, converted to ETH, and funneled through Tornado Cash—a mixing service notorious for obscuring crypto trails. The rapid transfers, including 752 ETH routed through the privacy tool, signal a potential exit scam.

Blockchain data reveals a pattern of hurried transactions: 1 ETH, 10 ETH twice, and 100 ETH withdrawn in minutes. Such behavior typically precedes rug pulls, where operators drain liquidity and vanish. Hypervault’s strategy relied on high-risk auto-compounding vaults and keeper bots to optimize yields across HyperEVM’s lending and liquidity protocols—a design that may have facilitated the heist.

The platform’s wallets held diverse assets like UPUMP, USDC, and UBTC, collectively valued at over $3.6 million. The incident underscores the persistent vulnerabilities in unaudited DeFi projects, where complex yield strategies can mask malfeasance.

How High Will ETH Price Go?

Based on current technical indicators and market developments, BTCC financial analyst Robert provides this ETH price outlook:

| Timeframe | Price Target | Key Factors |

|---|---|---|

| Short-term (1-4 weeks) | $3,800 - $4,300 | ETF outflows, whale movements, Bollinger Band support |

| Medium-term (1-6 months) | $4,500 - $5,200 | Fusaka upgrade implementation, institutional re-accumulation |

| Long-term (6+ months) | $5,500+ | SWIFT integration, ecosystem growth, broader crypto adoption |

Robert emphasizes that while short-term pressure exists due to institutional outflows and large holder distributions, the fundamental improvements through Ethereum's ongoing upgrades and increasing institutional blockchain adoption create a compelling long-term case. 'The current dip below $4,000 may represent a buying opportunity for patient investors looking at the 6-12 month horizon,' he concluded.